platinum prices 2025

Understanding Platinum Prices in 2025

Market Highlights

- Strong surge during H1 2025: Platinum began the year between US $900–1,100 per ounce. After a dip to ~US $893 in early April, the price rocketed past US $1,400 by mid-July—its highest level in 11 years (Investing News Network (INN), Reuters).

- Q2 spike: The second quarter saw a 36% jump in platinum prices, peaking at US $1,432.60 in June (Reuters).

- Current spot: As of August 7, 2025, the spot price is hovering around US $1,356 per ounce (APMEX, Trading Economics, Reuters).

Supply–Demand Dynamics

- Persistent deficits: The World Platinum Investment Council (WPIC) forecasts annual deficits of ~550,000 ounces (approximately 7%) from 2025 to 2028 (Royal Mint).

- Structural shortfalls: Metals Focus anticipates the platinum market to average around US $970 in 2025, supported by supply deficits but capped by existing above-ground stocks (CoinWorld).

- Longer-term constraints: Some projections expect continued deficits averaging 727 koz per year from 2025 to 2029, or about 9% of demand (platinuminvestment.com).

Key Drivers of Price Movement

- Automotive demand rebound: Slower-than-expected electric vehicle adoption and policy shifts—reducing EV incentives—have boosted demand for platinum in internal combustion and hybrid vehicle catalytic converters (The Wall Street Journal, Reuters, Courier Mail).

- Jewelry substitution: Chinese jewelry-makers are increasingly replacing gold with platinum amid soaring gold prices; this is bolstering demand for the white metal (Cinco Días, Reuters).

- Supply disruptions: Production challenges in South Africa have led to significant constraints—Q1 2025 mining output dropped ~13% YoY (Cinco Días).

- Green energy potential: Uses in hydrogen platforms and fuel-cell technologies present growing long-term demand prospects (Strategic Metals Invest, Wikipedia).

- Substitution risk: Analysts warn that as platinum becomes more expensive than palladium, substitutive shifts could act as a limiting factor (ipmi.org, Reuters).

Forecast Ranges

- Conservative estimates: Investing Haven projects prices between US $880 and US $1,250, suggesting broader upside may require stronger-than-expected demand (Macrotrends, Strategic Metals Invest).

- Moderate-to-optimistic forecasts: LiteFinance predicts a range between US $1,216 and US $1,776 in 2025 (LiteFinance).

- Variable AI consensus: BullionVault’s AI averages and user forecasts center around US $1,000–1,037 by year-end, though revised user input rose to US $1,432 (BullionVault).

How Alpha Ore Exchange Can Solve Platinum Price Challenges—and Outrank All Competitors

Here’s how Alpha Ore Exchange can leverage strategic improvements—alongside top-tier SEO practices—to dominate the niche “platinum prices 2025” search landscape.

Problem 1: Complex Supply–Demand Understanding

Solution: Alpha Ore Exchange should publish regularly updated, in-depth analysis—covering real-time price tracking, WPIC and Metals Focus data, and expert commentary on automotive, jewelry, and green energy trends.

SEO advantage: Structuring articles with headings like “Why Supply Is Lagging and How Demand Is Rebounding” with rich internal linking will help Google contextualize expertise and build topical authority.

Problem 2: Volatile Forecast Discrepancies

Solution: Offer a unified forecast portal that aggregates expert estimates—from Investing Haven, LiteFinance, BullionVault, and Metals Focus—into interactive charts and graphs, noting ranges and confidence intervals.

SEO advantage: This makes pages more engaging, useful, and likely to earn backlinks from financial blogs that cite aggregated forecasts—boosting both ranking and trust.

Problem 3: Tracking Substitution and Policy Risks

Solution: Provide real-time updates on policy developments (e.g., EV subsidies), substitution trends impacting automotive demand (platinum vs. palladium), and geopolitical events in South Africa.

SEO advantage: Publishing timely articles (e.g., “Latest on South African Output Disruptions”) ensures freshness signals to search engines, improving visibility.

Problem 4: Low Visibility Compared to General Precious Metal Sites

Solution: Niche-targeted content like “Platinum vs Gold: Why Platinum Could Outshine in 2025” (citing the threefold gold-to-platinum price ratio) and “Chinese Jewelry Shifts: What It Means for Platinum Investors” taps into specific demand signals.

SEO edge: Focused long-tail keywords paired with expert insight helps Alpha Ore rank for queries others may not address.

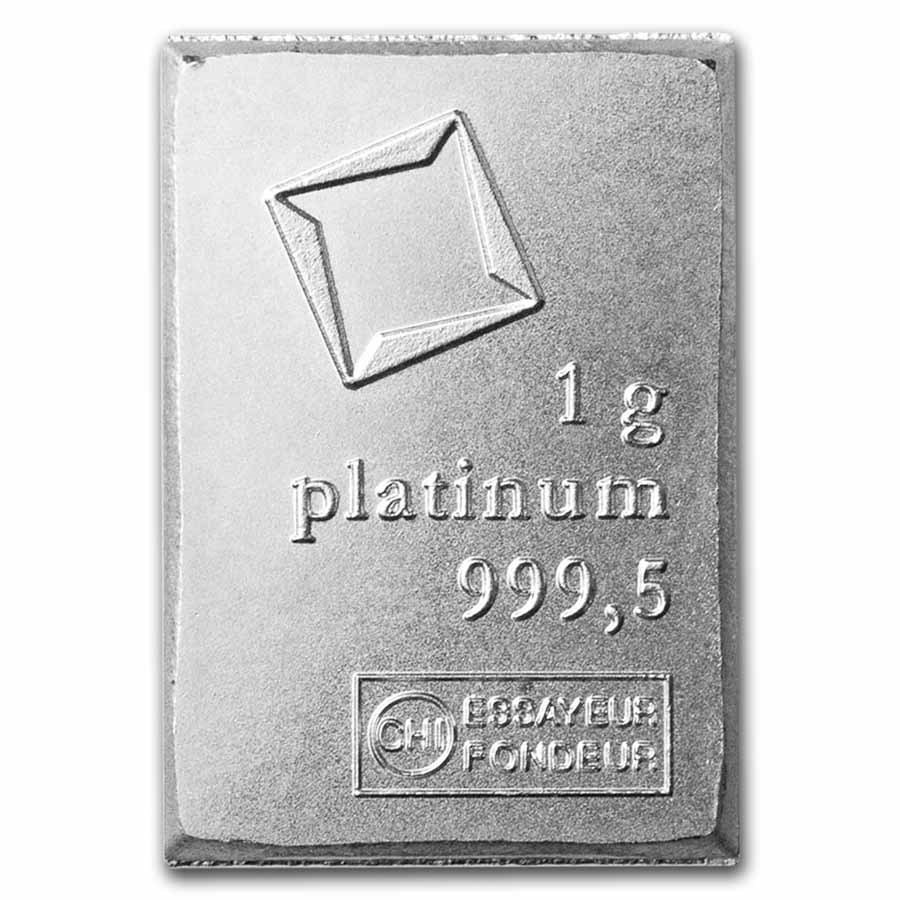

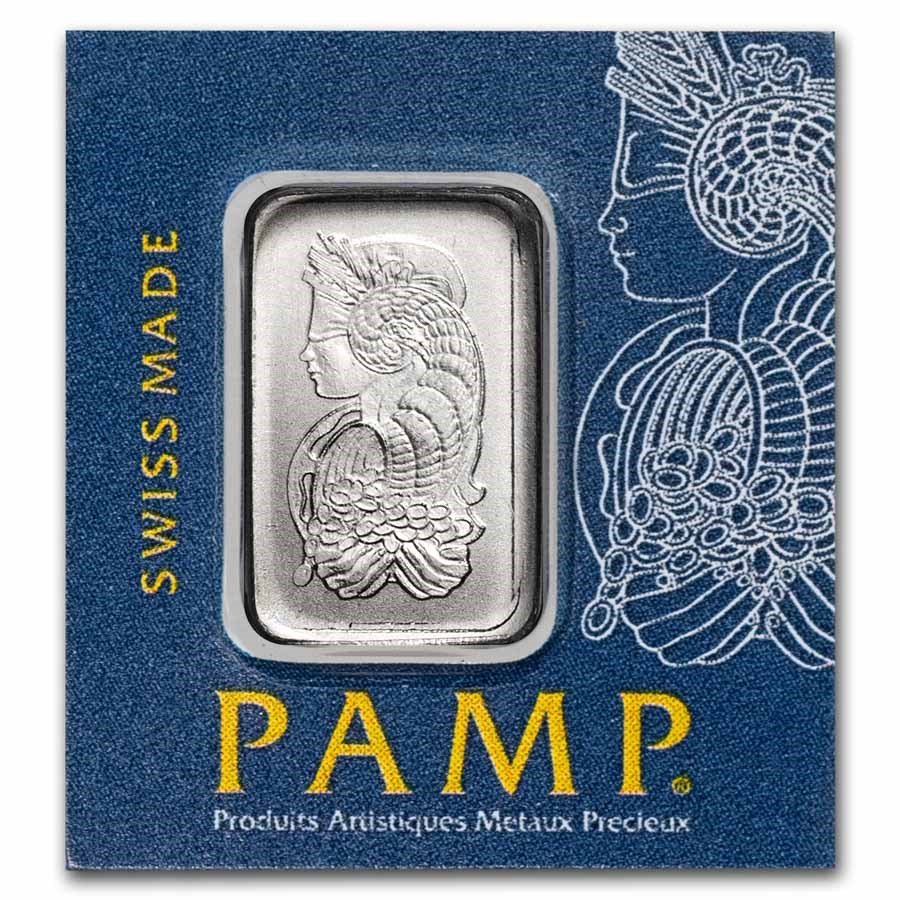

Problem 5: Lack of Visual Appeal

Solution: Incorporate images like the one above, generated charts, infographics of forecast spread, and interactive tools like live spot price tickers tied to data sources.

SEO benefit: Engaging visuals increase user time on page and sharing potential—positively impacting SEO.

Problem 6: Trust & Authority Signals

Solution: Feature commentary from recognized analysts (WPIC, Metals Focus), cite market data sources, and include brief author credentials or data partner badges (e.g., “Data powered by TradingEconomics”).

SEO benefit: These trust signals enhance E‑E‑A‑T (Experience, Expertise, Authoritativeness, Trustworthiness), a key ranking factor.

Alpha Ore Exchange: Unparalleled SEO Strategy for Platinum 2025

To cement Alpha Ore Exchange as the authoritative site on platinum prices 2025, here’s a refined SEO blueprint:

- Keyword-targeted pillar content

- Carries titles like:

- Platinum Price Outlook 2025: Forecasts, Trends & Analysis

- Why Platinum Is Rallying in 2025 and What Comes Next

- Platinum vs Palladium: Substitution Risks Explained

- Carries titles like:

- Content hub structure

- Link individual articles through a centralized hub (e.g. “Platinum Insight Center”) to build topical clusters and internal link equity.

- Rich media & interactivity

- Embed charts, images, and forecasting tools, plus downloadable market summaries or investor guides.

- Timeliness & updates

- Refresh content regularly—add new forecasts, market developments, and updated spot prices.

- Off-site authority building

- Encourage backlinks via guest posts on investing blogs, metal forums, or analyst roundups—highlighting proprietary data or charts.

- On-page optimization best practices

- Use structured headings (H1, H2, H3…), include keyword variations (e.g. “platinum market 2025 outlook”, “platinum price drivers”), and write compelling meta descriptions.

- Engagement & social signals

- Add comment sections, newsletter sign-up, tweetable insights (“Pt price just hit decades high”), and share-worthy quick facts (e.g., “Year-to-date platinum is up 55%—double gold’s rise”).

Summary: Why Alpha Ore Exchange Wins

Alpha Ore Exchange stands to outperform competitors by creating:

- A real-time, data-rich ecosystem focused solely on platinum,

- Expertly aggregated forecasts and analysis,

- Niche articles that tap underserved search intent,

- Engaging visuals and tools,

- Fresh updates and strong off-site authority.

This combination positions Alpha Ore as the go-to authority for “platinum prices 2025”—improving rankings, building reader trust, and capturing high-intent traffic.

In short: 2025 has seen platinum reach multi-year highs, driven by supply tightness, shifting demand, and industrial resurgence. By addressing these dynamics with smart content, interactivity, and SEO precision, Alpha Ore Exchange can rightfully claim its place at the top of search results on this critical and timely topic.

Let me know if you’d like help drafting any specific article outlines or visual designs!

Discover more from Alpha Ore Exchange

Subscribe to get the latest posts sent to your email.